Establishing offshore companies in Dubai is one of the smart strategies that many investors and entrepreneurs resort to to benefit from the advanced economic environment and modern infrastructure that the emirate provides. Dubai, thanks to its strategic location and advanced legislation, has become a global hub for business and trade, making it an ideal destination for establishing offshore companies. These companies are characterized by several advantages, including tax exemption, asset protection, confidentiality, and flexibility in management. Thanks to these advantages, investors can achieve greater efficiency in managing their business and expanding the scope of their activities internationally.

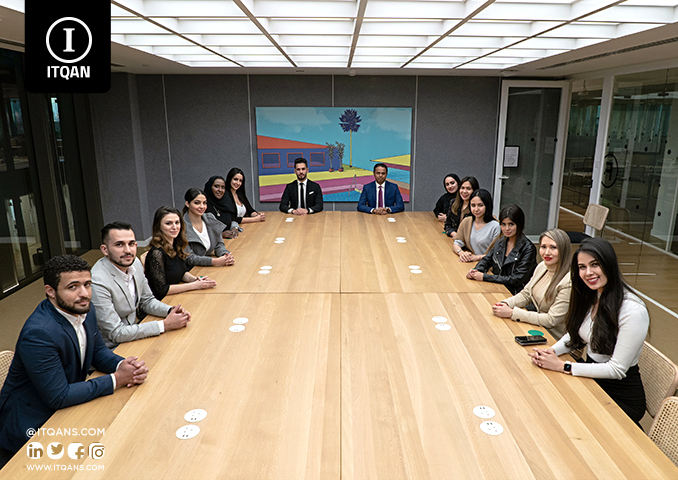

Cooperating with Itqan Company for setting up offshore companies in Dubai can be the ideal option to ensure that the process runs easily and effectively. Itqan Company has extensive experience in the field of establishing companies and providing the necessary legal and administrative consultations to achieve full compliance with local and international legislation. Through its cooperation with local authorities and deep knowledge of the required procedures, Itqan Company provides comprehensive support to investors, starting from choosing the appropriate type of company to preparing the necessary documents and submitting them to the competent authorities.

Establishing offshore companies in Dubai

جدول المحتوى

ToggleWhat are offshore companies?

Many commercial companies operate in countries other than those to which they belong or in which they established their business as a country of nationality, and the trend for these foreign businesses is often due to the investment incentives offered by those countries, including low taxes and packages of facilities and aid they provide.

What is meant by Offshore Company, if we take the literal translation term is (far coast), or outside the borders, or beyond the seas, all of which mean outside the borders of the state. Offshore companies are companies registered according to the law of the country from which it carries out its activity and in which the registrar of the company resides.

They are also legal commercial entities or a group of companies that participate in providing and manufacturing commercial services outside the borders of their countries. Companies that invest in the fields of mining, oil fields, and gas extraction fields in the distant seas of their countries may fall under this name.

Characteristics of offshore companies

Offshore companies are a special type of legal entity that are incorporated in jurisdictions or countries outside of the founder’s primary business of residence or operation. These companies are commonly used for tax planning, asset protection, and wealth management purposes. Establishing an offshore company gives business owners many advantages that may not be available in their country of original residence, making it an attractive option for global companies and individual investors alike. By deeply understanding the characteristics of offshore companies, investors can make informed decisions that take advantage of these unique advantages. Characteristics of establishing a company in Dubai

- Tax exemption

One of the most prominent characteristics of offshore companies is full or partial exemption from taxes in the country in which they are established. This typically includes income, capital gains, and inheritance taxes, which can provide significant tax savings.

- Confidentiality and privacy protection

Many jurisdictions offer strong protections for the anonymity of owners and shareholders in offshore companies. This confidentiality means that information regarding the ownership and financial activities of the company is not available to the public or foreign governments.

- Asset protection

Offshore companies can help protect assets from lawsuits and financial settlements, as the assets are transferred to a jurisdiction with strong asset protection laws.

- Ease of establishment and management

The procedures for establishing offshore companies are simple and quick, with limited administrative and regulatory requirements. This means that companies can get started quickly and at a relatively low set-up cost.

- Flexibility in business management

Offshore companies provide high flexibility in managing the business, including the freedom to organize the company structure, appoint directors, and conduct meetings anywhere around the world.

Validity of offshore companies

Offshore companies are an important part of the global economy, as they are incorporated in jurisdictions outside of their owners’ primary businesses. Investors and companies use this type of legal entity to achieve various goals such as tax planning, asset protection, and wealth management. However, understanding the validity and legality of these companies requires a careful look at the legislation and regulations that govern them. By exploring the viability of offshore companies, individuals and companies can make informed decisions that ensure compliance with laws and avoid legal consequences. Authority to establish a company in Dubai

- Compliance with local and international laws

To ensure the viability of an offshore company, founders must comply with local laws and regulations in the jurisdiction in which the company is incorporated. This includes properly registering the company, paying the required fees, and adhering to the required financial disclosures.

- Legal and legitimate purposes

Offshore companies must be used for legal and legitimate purposes. Common legal purposes include tax planning, asset protection, and facilitating international business. You should avoid using these companies for money laundering, tax evasion, or other illegal activity.

- Transparency and disclosure

Although offshore companies are known for their secrecy, a commitment to transparency and necessary disclosure is vital to ensuring their viability. Companies must submit periodic financial reports and cooperate with regulatory authorities when needed.

Conditions for establishing offshore companies in Dubai

Conditions for establishing offshore companies in Dubai

According to the regulations issued by the Jebel Ali Free Zone Authority regulating the work of offshore companies, when establishing companies, the following regulations were established:

- Any one or more persons may submit a signed application to the Registrar for a certificate of incorporation of an offshore limited liability company.

- An offshore company may be established in order to conduct any lawful business, except for what is contrary to the conditions and specified under the regulations.

- Each offshore company has a management structure and one class of shares (of equal value).

- The company that wants to practice its activity must obtain a license for this purpose from the competent authorities.

- Offshore companies are not entitled to practice banking, insurance, or anything prohibited by the competent authorities from time to time.

- Every company must issue a financial statement that is audited by a certified auditor and filed with the Registrar of Companies.

- The company must have a registered office in Jebel Ali Free Zone and have a legal agent approved by the zone authority.

- Signature of the application by the founders, provided that it states the following:

- The name of the thousand shore company, ending with the word “limited”.

- The address of the registered office of the company and the purpose of its establishment.

- work nature.

- The amount of share capital proposed to be registered and divided into shares of a fixed amount.

- Full names of the founder or founders, and persons serving as board members.

- Any other details that the Registrar may request.

Our company’s role in establishing offshore companies in Dubai

Establishing offshore companies in Dubai is a strategic step for investors looking to benefit from the advanced business environment and tax exemptions. Dubai, with its unique geographical location and world-class infrastructure, provides golden opportunities for investors to expand their businesses and effectively protect their assets. Offshore companies provide investors with great flexibility in managing their businesses and provide them with high confidentiality that protects their commercial interests.

Cooperating with Itqan Company to establish offshore companies in Dubai guarantees investors access to integrated and customized services that meet their specific needs. Itqan Company, with its deep experience and knowledge of local and international legislation, provides investors with specialized advice that ensures full compliance with the laws and helps them avoid legal and administrative obstacles. Through its specialized team, Itqan Company provides comprehensive support that starts from choosing the most appropriate type of offshore company to preparing and submitting all necessary documents to the concerned authorities.

The process of establishing an offshore company in Dubai with Itqan Company includes several basic stages. It begins with a careful understanding of the investor’s goals and needs, followed by choosing the right type of offshore company and registering it legally. Itqan Company handles all legal and administrative procedures, saving investors time and effort and enabling them to focus on developing their business. In addition, the company provides post-incorporation services such as account management and ongoing compliance with local and international laws.

Frequently asked questions about establishing offshore companies in Dubai

What is an offshore company?

An offshore company is a legal entity established in a jurisdiction outside of the owner’s primary business residence or operation. Commonly used for tax planning, asset protection, and wealth management purposes.

What are the main advantages of establishing an offshore company in Dubai?

Tax exemption: Offshore companies in Dubai enjoy tax exemptions on profits and income. Asset Protection: Provides strong protection for assets from lawsuits and financial claims. Confidentiality: Ensures the confidentiality of information related to ownership and financial activities. Ease of establishment and management: Simple and quick procedures for establishing and managing a company.

What are the basic steps to establish an offshore company in Dubai?

Choosing a trade name: Determine a suitable name for the company that complies with regulations. Submitting the application: Submit the application to the competent authorities with all required documents. Payment of fees: Payment of fees related to registration and licenses.

What are the legal requirements for establishing an offshore company in Dubai?

Minimum Capital: Some jurisdictions require a minimum capital. Shareholders and Directors: Identify and register shareholders and directors. Legal Documents: Submit certified copies of passports, addresses, and other required documents.